New Delhi, September 4, 2025

India’s Goods and Services Tax (GST) has always been more than just a tax—it’s been a mirror of how the Indian economy formalises, adapts, and grows. Eight years after its introduction in July 2017, GST has now entered what many are calling its most important phase yet: record revenues paired with a bold reform.

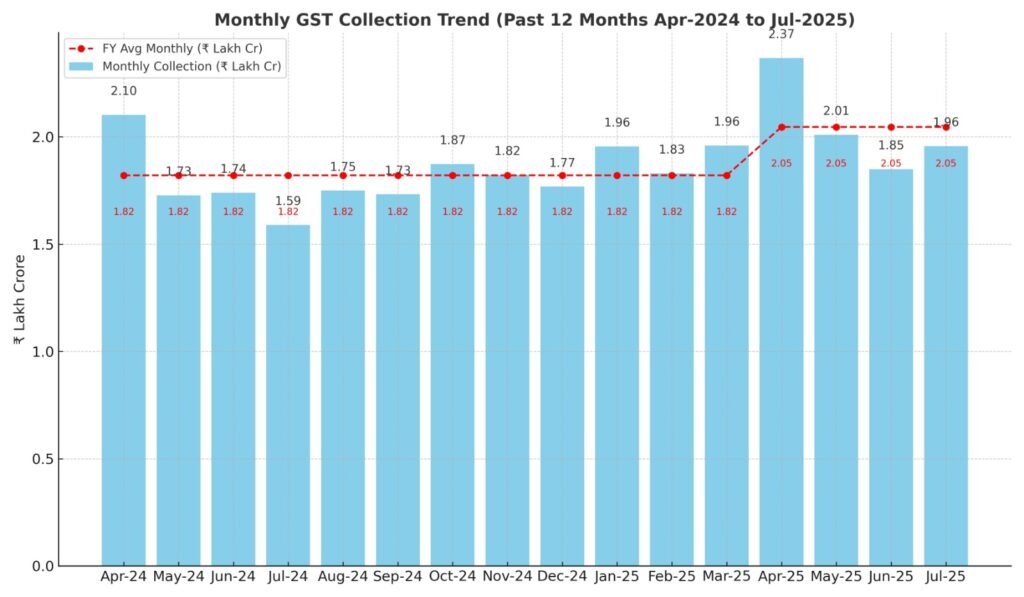

In August, collections stood at nearly ₹1.95 lakh crore, the fourth consecutive month above the ₹1.8 lakh crore mark. Earlier this year, April 2025 delivered the highest-ever monthly GST collection at ₹2.36 lakh crore, showing how resilient compliance and domestic demand have become.

The Finance Ministry has set its sights on an ambitious milestone: ₹22 lakh crore in GST revenues by FY2025–26, powered by the recent GST 2.0 reforms. Policymakers believe the simplified slabs, paired with AI-led compliance checks, will broaden the tax base while making compliance smoother for honest taxpayers.

But the number is more than just a fiscal target—it’s a statement. Crossing ₹22 lakh crore would mean India has successfully moved from fragmented tax structures to a unified system that funds infrastructure, welfare, and digital transformation at scale.

For businesses, this goal translates into a tighter but clearer compliance regime. For households, it means more affordable essentials and transparent pricing. And for India’s economy, it signals a growing maturity—where reforms are no longer disruptive shocks, but steady steps toward long-term stability.

As GST collections stabilize above ₹1.8 lakh crore month after month, the ₹22 lakh crore benchmark no longer feels out of reach. The question now is whether India can sustain both revenue growth and fairness—ensuring that reforms don’t just fill the exchequer, but also touch the daily lives of its people.

On September 3, Finance Minister Nirmala Sitharaman announced the GST 2.0 rationalisation – a major simplification of tax slabs aimed at reducing the burden on households and making compliance easier for businesses.

The story of GST today is not just one of numbers; it’s one of balance—between households and industry, between enforcement and ease, and between revenue needs and fairness.

A Journey of Growth

When GST was first rolled out in July 2017, critics questioned whether India’s diverse economy was ready for such a sweeping reform. Initial teething troubles—like technology glitches and refund delays—seemed to confirm those fears.

Yet, step by step, the system matured. From ₹7.19 lakh crore collections in FY2017–18 to ₹22.08 lakh crore in FY2024–25, GST has grown in lockstep with India’s economy. The average monthly collection has nearly doubled in this period, crossing ₹1.84 lakh crore in the last financial year.

Even the pandemic setback in FY2020–21, when collections dipped to ₹11.36 lakh crore, gave way to recovery. The years since have seen not just higher collections, but also more consistent revenues, with over 10 consecutive months now above ₹1.7 lakh crore.

This consistency is crucial: it means businesses can plan better, governments can allocate resources with greater confidence, and India’s fiscal health gets stronger.

What’s Driving the Numbers?

Behind the headline figures lie some key drivers:

- Economic growth: India’s GDP is expanding at 6–6.5%, with manufacturing PMI hitting a 16-month high in July 2025. Consumer demand in both metros and Tier-2 cities remains strong.

- Compliance tools: Mandatory e-invoicing for businesses above ₹5 crore turnover (from Jan 2025) has tightened backend reporting. AI-based tools now auto-flag mismatches in filings.

- Refund efficiency: Refund timelines have halved in the past year. July 2025 refunds hit ₹27,147 crore, up nearly 67% YoY.

- Sectoral anchors: Manufacturing (autos, cement, processed food), logistics, e-commerce, and digital services continue to expand the GST base.

This mix of economic resilience and technological enforcement has created a tax system that is steadily delivering results.

GST 2.0: Reform with a Human Touch

On September 3, 2025, Finance Minister Sitharaman unveiled what many are calling the biggest structural reset since GST’s inception. Effective September 22, GST will now operate with fewer, simpler slabs:

- 0% (Nil) – Essentials like life-saving medicines, school notebooks, UHT milk, and packaged paneer.

- 5% – Daily household items: toothpaste, soap, shampoo, butter, namkeens, bicycles, diapers, thermometers, fertilizers.

- 18% – Standard goods and services: small cars, cement, TVs above 32”, ACs, motorcycles up to 350cc.

- 40% (Luxury & Sin) – Cigarettes, pan masala, sugary drinks, casinos, online gaming, luxury vehicles, yachts, and personal aircraft.

This restructuring does three important things:

- Simplifies compliance by reducing disputes over classification.

- Eases household budgets, with essentials and personal care items now firmly in the 0% or 5% bracket.

- Reinforces progressive taxation, shifting the burden toward harmful and luxury consumption.

For a middle-class family in Jammu, for instance, this means a basket of everyday goods—from ghee to pencils—will now cost less. For industries, especially in autos and FMCG, the clearer structure reduces uncertainty and improves planning.

What Gets Cheaper, What Gets Costlier

Cheaper:

- Food products like butter, ghee, cheese, and namkeens.

- Personal care items including toothpaste, soap, and hair oil.

- Educational materials: notebooks, maps, globes.

- Health insurance premiums and select medicines.

Costlier:

- Sin goods: pan masala, cigarettes, sugary drinks.

- Luxury services: casinos, online gaming, premium real estate.

- High-end transport: luxury motorcycles, yachts, private jets.

The impact is intentional—make daily living more affordable while discouraging harmful consumption.

Industry and Business Impact

Markets have already responded positively. Auto and FMCG stocks saw a small rally as analysts predicted higher volumes driven by lower effective tax rates. Electronics and cement are also expected to benefit.

But businesses will need to recalibrate:

- MSMEs face tighter compliance as the e-invoicing threshold is likely to drop further to ₹2 crore turnover by FY26.

- Pricing strategies will have to be adjusted as goods shift from 28% to 18%.

- Luxury segments may face short-term dips in demand, but the government views this as a fair trade-off.

Future of GST: The Road Ahead

The GST Council has signalled more changes in the pipeline:

- Wider base: Petroleum, digital assets, and possibly real estate could soon come under GST.

- AI audits: Predictive compliance systems will alert businesses of mismatches before filing deadlines.

- Risk-based registration: New businesses will be tagged with compliance risk scores at onboarding.

With these steps, India could see monthly collections consistently cross ₹2 lakh crore, potentially pushing FY2025–26 collections beyond ₹24 lakh crore.

Conclusion: From Data to Daily Life

The story of GST 2.0 is not just about numbers—it’s about balance. It’s about ensuring the government has the revenue it needs while easing the burden on households. It’s about simplifying a complex tax system without losing sight of fairness.

In just eight years, GST has gone from a fragile experiment to a stable backbone of India’s fiscal system. With record revenues and now a simplified structure, GST 2.0 may finally be what the system was always meant to be: a unifier of India’s vast markets, a tool for equity, and a reflection of a maturing economy.

📩 For more analysis on India’s economy, taxation, and policy reforms, follow True Roots Media or write to us at info@truerootsmedia.com.